The Biggest Banking EleFiat in the Room: The Federal Reserve Requirement - Or The Lack of One

How the Federal Reserve Ratio Change Down to ZERO PERCENT in 2020 Contributed to The Crisis Unfolding Today

The US economy has been struggling and teetering on many fronts - from delayed consequences of the Covid response such as the non-transitory inflation and supply chain disruptions, to the blowback of the American approach to the Ukraine/Russia war (which my previous artices in March of 22’ warned of ).

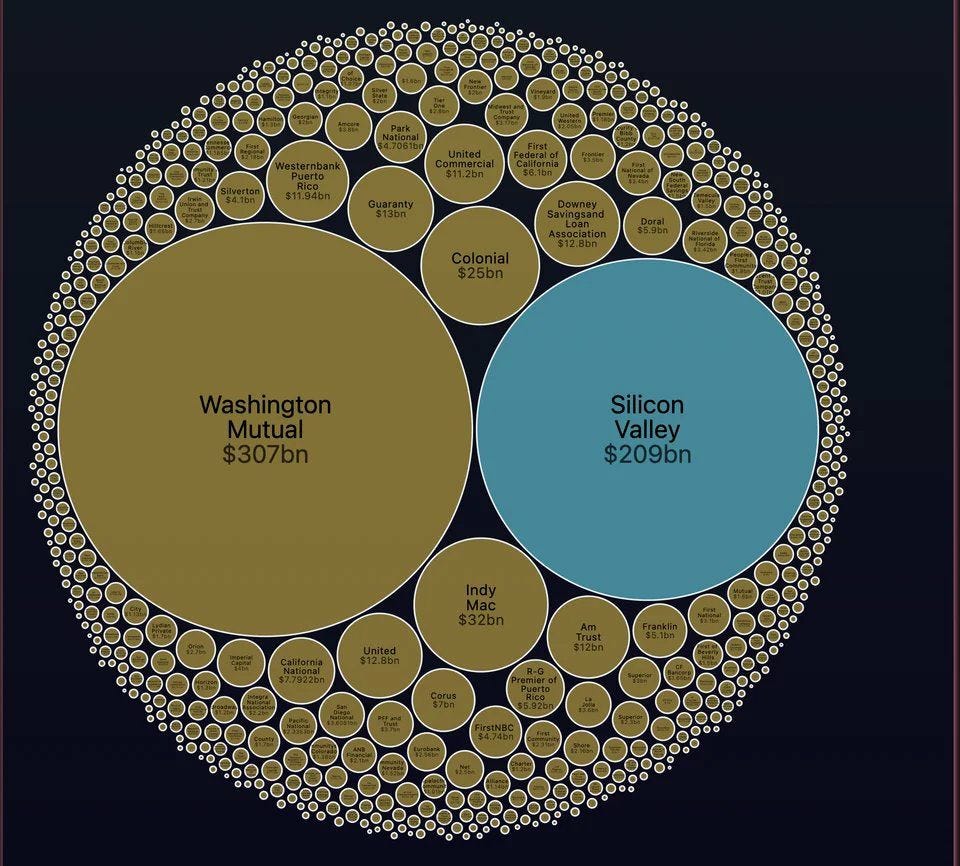

Then the Silicon Valley Bank(SVB) collapse happened, sending shockwaves of worry throughout the banking industry and finance sector as more bank failures followed...Credit Suisse(CS), whose solvency and balance sheet troubles have been causing discussion for months, was sold to UBS, who was forced by the Swiss government to buy the company in March at a “price per share marked a 99% decline from Credit Suisse’s peak in 2007.”

Silvergate and Signature Banks also failed, and rumors persist around Deutsche Bank and First Republic Bank.

But there is little discussion about the root issue —Fractional Reserve Banking.. More specifically: undefined “Fractional” Reserve Banking.

You might be asking, “Why is that ‘fractional’ in quotes?”

Because….

The reserve ratio was lowered to an unprecedented figure of 0% (ZERO PERCENT in case the emphasis isn’t clear enough) in 2020..

If you don’t have to hold ANY reserves to back deposits, if you don’t even need a fraction of deposits to be backed…then it is a bit disingenuous to call it fractional reserve banking, is it not?

While many such as the great Ron Paul have tirelessly pointed out that the fractional reserve banking has a ton of issues unto itself, it is worth noting that before 2020 there has always been minimum reserve deposits for banks. Big banks had to maintain 10% reserves as a standard, although many banks were only obligated to maintain as little as 3% reserves.

Before the introduction of the Fed in the early 20th century, the National Bank Act of 1863 imposed 25% reserve requirements for U.S. banks under its charge.

While Keynesians and others defend fractional reserve banking, which is bad enough in this author’s opinion, the whole debate about the merit(or the evils) of fractional reserve banking becomes obsolete, maybe even a tragic joke absolutely fit for this clown-word, when we have completely abandoned any minimum reserve requirements to make place for an even more ludicrous, totally hollow, “fractional” reserve banking system.

Why is there panic and fear of deposits not being safe? Fractional Reserve Banking….

But at least in previous bank runs, there were requirements for reserves to back deposits.

Indeed, susceptibility to bank runs is the most commonly acknowledged drawback of the fractional reserve system, even by mainstream sources. This is why reserve ratios/requirements were created.

Since March 2020, the US has had no reserve requirements, thus we have moved away from fractional reserve banking, towards “Undefined Reserve Banking”.

What happens when you divide a number by 0? Mathematically it is “undefined”, you don’t get a number. it is not a fraction.

But don’t worry!

History of the Federal Reserve’s Reserve Requirement Ratio

Investopedia’s Entry on Fractional Reserve Banking, citing various pages from the Federal Reserve’s website, Reports:

Reserve requirements for banks under the Federal Reserve Act[of1913] were set at 13%, 10%, and 7% (depending on the type of bank) in 1917. In the 1950s and '60s, the Fed had set the reserve ratio as high as 17.5% for certain banks, and it remained between 8% to 10% throughout much of the 1970s through the 2010s.[2]

During this period, banks with fewer than $16.3 million in assets were not required to hold reserves. However, banks with fewer than $124.2 million in assets but more than $16.3 million had to have a reserve size of 3%, and those banks with more than $124.2 million in assets had a 10% reserve requirement.[2]

On March 26, 2020, the 10% and 3% required reserve ratios against net transaction deposits were reduced to 0% for all banks, essentially removing the reserve requirements altogether.[2] It was replaced with Interest on Reserve Balances (IORB), or interest paid on reserves the banks hold as an incentive rather than a requirement.[3]

Removing the reserve requirement to 0% ….What?! And people wonder why banks are running insolvent and susceptible to bank runs?

Forbes ran the headline: “Silicon Valley Bank Collapse Suggests 0% Reserve Requirement Won’t Halt Bank Runs”:

I stumbled across this headline when scanning to see what corporate media was saying about the reserve ratio in relation to the SVB collapse… pure and total newspeak. The 0% reserve requirement “won’t halt bank runs” implies that the policy shift was designed to either prevent bank runs, or that anybody in their right mind thought it would have a beneficial impact on preventing bank runs.

Any honest, sane actor would admit that going to the absolute extreme of fractional reserve banking would make the system *more* susceptible to bank runs.

What is really the chefs kiss on that Forbes article above is that while the headline reads like 1984 newspeak, you then read it and he drifts very close to the sane conclusion: That Ron Paul was right and that 100% reserves are what would prevent a bank run, not 0%…

Peter Cohan wrote for Forbes that:

“In May 2002, the reserve requirement was 10%, according to Economic Policy Review.

That strikes me as fine as long as there are no lines of depositors at bank branches looking to withdraw their money,

So it made me very nervous to discover that the Fed lowered the reserve requirement to 0% three years ago. As the Fed announced in March 2020, “The Board eliminated reserve requirements for all depository institutions. [The goal of this change] was to support the flow of credit to households and businesses and thereby promote [the Fed’s] maximum employment and price stability goals.”

If a bank run panic begins to spread, I think the best way to stop it is for banks to boost their reserve requirement to 100%.”

A 0% reserve requirement(or reserve ratio) is the most extreme polarity of fractional reserve banking, and the intrinsic nature of fractional reserve banking is what makes bank runs even possible/ a threat to begin with. If banks backed deposits with 100% reserves, bank run would be a non-issue - simple as.

SIllicon Valley Bank (SVB) was the 2nd largest consumer, savings and loans bank to ever collapse, second only to that of Washington Mutual which collapsed in 2008.

It was a classic bank run by all accounts. Why are banks susceptible to runs in the first place? Because of fractional reserve banking.

It is worth noting that on March 10th Bloomberg reported that “Peter Thiel’s Founders Fund had no money with Silicon Valley Bank as of Thursday morning as the bank descended into chaos”…. The next day the Bank would fail.

The Washington Examiner would publish the headline: “SVB collapse: Peter Thiel’s role scrutinized as spark of bank run”

While it would be surprising to little informed people if CIA-affiliated Thiel did have a role in the bank run, as if there was a sort of controlled demolition going on to assist in introducing and ushering in CBDC’s…..

As the agenda to push centralized digital bank currencies(CBDCs) heats up, the issue has pushed its way into the zeitgeist strongly these past few months - and continues to do so. As more entities and persons begin to call for CBDC’s come, from both the Western Axis as well as the emerging BRICs axis, so do more condemnations begin to emerge.

March 9th — Congressman Warns Digital Dollar Could Expand 'Financial Control' Over Americans

March 9th - Rep. Tom Emmer says he has strong concerns that a CBDC could jeopardize American civil liberties.

March 11 - South Dakota's Governor Vetoes Bill That Would Have Paved the Way for Central Bank Digital Currency

March 14— Central Banks’ Digital Currency Plans Face Public Backlash

April 13 — Robert F. Kennedy Jr. Joins Ron DeSantis in Railing Against CBDCs

But make no mistake, it is an uphill battle, and the governments of the world, and the powers they represent are afraid of losing control over the population, and missing the opportunity to further entrench it. In this author’s opinion, CBDCs are coming, and the powers that be are seeking to transmutate the pitfalls, the collapse, the breaking point of this current fiat fractional reserve system they have benefitted so much from, into fiat 2.0 with CBDC’s that give them an even greater level of control.

March 16 - Western Governments Are on The Verge of Introducing Expiring Money

— The European Central Bank (ECB) is considering using negative interest rates, a tool that erodes the value of your money, as it introduces the digital euro — its central bank digital currency (CBDC).

The notion of expiring money, to me seems a hyperbolic emanation of the underpinning of modern economic systems which premise the policies and system mechanics on encouraging spending but discouraging and penalizing saving. Systemic theft of savings, really.

”wHaT aBoUt QuAntItAtiVe TiGhTeNinG?”

Even during periods of QT, like we have been in the past year with the Fed raising interest rates, the money supply is still inflating, and the majority of people who use a savings account to save money are losing purchasing power, and inflation outpaces the rise in wages - for those who are lucky enough to even get a raise. But the serfs should just be happy if their bank doesn’t gamble all their money away and implode, right? And those who arnt’t saving dollars in a savings account are probably losing money during QT(as the markets are negatively impacted and the average retail investor is losing money).

And because so many things are breaking right now, or on the verge of it, nobody really knows if the FED is even going to maintain the pressure, or if they will lower interest rates soon as a result of the blowback, which will allow inflation to keep running out of control. In chess, the Fed would be in what is known as a “Zugzwang”

At the end of the day I am trying to illustrate that the system we have been dealing with is fundamentally broken and poorly designed(at least for those who suffer under it).

The monteary system is a shitshow:

The banking and monetary system needs reform. Nearly everyone agrees on that I suppose, the debate is by what means, and what should the new system look like?

And when this house of cards inevitably falls down for good, they are going to introduce CBDC’s as the magic solution. I pray people don’t fall for it. It won’t fix anything. The solution is hard, sound money. The solution is/are decentralized systems that don’t side step accountability or require racketeering and extortion methods to get people to adopt.

Make No mistake, The Bankers ARE Threatened.

If people don’t go along with the CBDC agenda - and stateless, decentralized, monetary systems continue to be adopted, and parallel economies continue to emerge and grow - the powers that be are at risk of becoming that powers that were.

The European Central Bank President, Christine Lagarde, warned just a couple weeks ago that Central Banks Could be “Losing Control” Without CBDCs

Lagarde stated:

“Where do we stand, we Central Bankers? We have been operating as a monetary anchor in relation to Commercial Banks and private money. If we are not in that game, if we are not involved in experimenting and innovating in terms of digital central bank money, we risk losing the role of anchor that we have played for many, many decades.”

It is this author’s opinion that more countries will take Nigera’s approach to coercing citizens to using CBDCs. At first, Nigera started off by incentivizing the E-Naira adoption by positive incentivizes. But that didn’t work out well.

Last October, Financial underground wrote about how “The eNaira has been a massive failure.”

According to Bloomberg, only 1 in 200 Nigerians use the eNaira. That’s even after the government implemented discounts and other incentives as desperate measures to increase adoption.

This came as a surprise to the elites.

Nigeria has one of the highest Bitcoin adoption rates in the world—ranking #11 among all countries.

Bitcoin’s ability to bypass the government’s capital controls—which restrict the use of foreign currencies and sending and receiving money from abroad—was a big draw for Nigerians, as it is in other countries with these repressive policies.

A long history of rampant currency debasement in Nigeria—including six devaluations in recent years—also helped spur the adoption of Bitcoin, which is totally resistant to inflation.

In short, the elites have miscalculated. They figured Nigerians wouldn’t be able to differentiate between Bitcoin and the eNaira—they are both digital currencies, after all.

The Bloomberg article admitted, “Nigerians’ passion for cryptocurrencies doesn’t extend to the central bank offering.”

It also said Nigerians view the eNaira as “a symbol of distrust in the ruling elite” and that the people view the government as “hostile to them and therefore have no interest in anything it introduces.”

Less than 2 months later, as the Nigerian government was failing to encourage voluntary adoption of the CBDC, they would opt for a more coercive approach. Bloomberg would publish the headline, “Nigeria Caps ATM Cash Withdrawals at $45 Daily to Push Digital Payments”

They know they are losing control, they are losing power. The decentralized, stateless currency revolution threatens the parasitic central banking systems that are riddled with perverse incentives and corruption vulnerabilities, and those that are stakeholders in them, that have exploited the many for the benefit of the few for so long.

It is worth noting, stateless/state currency isn’t the only fault line.

Returning to hard-money - even if it is state-issued - would be far preferable than remaining under the current economic tyranny. Jeffrey Tucker recently wrote a piece for Epoch Times titled, “Is A New Gold Standard Possible?” in which he wrote:

”The price of gold is once again testing its all-time highs as both individuals and institutions flee the chaos of our times toward safety… For a century, the elites have wanted gold to disappear from the subject of money. But it keeps not happening.

Like clockwork, there is renewed interest even in the old gold standard. According to Yahoo finance:

“Rep. Alex Mooney (R-WV)—joined by Reps. Andy Biggs (R-AZ) and Paul Gosar (R-AZ)—introduced H.R. 2435, the Gold Standard Restoration Act, to facilitate the repegging of the volatile Federal Reserve note to a fixed weight of gold bullion.Upon passage of H.R. 2435, the U.S. Treasury and the Federal Reserve are given 24 months to publicly disclose all gold holdings and gold transactions, after which time the Federal Reserve note dollar would be formally repegged to a fixed weight of gold at its then-market price.”

The timing is more brilliant than it appears. The dollar as the international reserve currency—which it has been since 1944—is newly under threat. China, Russia, India, Saudi Arabia, and Brazil, with other nations joining, have all agreed to work toward independence from the dollar. This is because the Biden administration has so heavily politicized its use as a reserve currency, even going so far as outright confiscation of assets owned by Russians. U.S. policy is using the dollar as a weapon, and it should come as no surprise that many nations don’t like that.

There is the additional and very real threat, too, of a Central Bank Digital Currency in which the Biden administration has shown great interest.

This would permit a massive invasion by the government and its monetary oligarchs into our private lives and permit new levels of population control that will make the Bill of Rights a dead letter.

If there were ever a time to push for a new gold standard, it is now.

Speaking of fluoride, in recent news from last month: “US Government Releases Censored Documents Detailing Fluoride’s Impact On Childhood IQ”.

In the 2nd article of my 3 part series following Russia’s invasion, I explain the critical point we are at in history as the economic order is breaking down, and recap the fall of Bretton Woods and the impact of Nixon taking us off the gold standard.

In the article, after covering Saudi Arabia expressing interest in trading in the Yuan over the dollar, I write:

This move by Saudi Arabia is significant in terms of the world energy market which, as this conflict thus far has demonstrated, impacts nearly all extraneous markets. The Petrodollar system, the global standard of trading oil in US dollars which has been a major factor in keeping the US dollar the dominant world reserve currency, was established largely with the support and help of Saudi Arabia. Investopedia summarizes:

“The emergence of the petrodollar dates back to the early 1970s[1974] when the U.S. reached an agreement with Saudi Arabia to standardize the sale of oil based on the U.S. dollar.”

Notice how the agreement happened in the early 1970’s, beginning in 1974, directly following the total collapse of the Bretton Woods system 1972 , in which Nixon removed the gold-standard and turned “Goldbacks” — dollars backed by gold--into “Greenbacks” — dollars backed by nothing. The Petrodollar is infamous for being the backbone of the dollar’s dominant reserve currency status. While many, like Ray Dalio who was featured in the first article, are pointing out the world economic order seems to be on the brink of a massive transition, many experts are calling for a new Bretton Woods conference, which in 1944 established the IMF and the original Bretton Woods system.

I would conclude the article by stating:

”As Saudi Arabia is seeking to abandon the Petrodollar, India is seeking to phase out the dollar as a reserve currency in trade with Russia (and likely its trade partners such as China in the future), the dollar’s reserve currency status faces a great threat.

Saudi Arabia’s departure from the standard it was instrumental in creating could embolden other countries to follow suit. Likewise, as multiple countries bolster relations with Russia and China(Or allies of theirs, such as the UAE meeting with Syrian president Assad), and defy the US’s wishes and implicit or direct threats, this could embolden others to do the same in the future-dismantling US hegemony. We could be witnessing the fall of the US empire, and its reserve currency, coincided by the rise of an emerging power structure and world economic system in which BRICS nations rise as the new dominant power of the globe.”

Since then of course, my extrapolations have proven to be correct, as Saudi Arabia has further distanced itself from the US, even expressing interest in joining BRICS(as many other countries have including the UAE), which has also become a leading topic of discussion.

China just last month completed their first liquid natural gas(LNG) trade with Saudi Arabia denominated in the Yuan.

2 months ago a Russian diplomat claimed it isn’t just BRICs that is threatening US hegemony, but that Saudi Arabia was “eager to join” the SCO - the Shanghai Cooperation Organization - which some have begun to call the “NATO” of the east as it is seen as a geopolitical counter balance to the alliance. Created in 2001, the SCO is described by Newsweek as “a six-member political, economic and military coalition including China, Russia and the Central Asian states of Kazakhstan, Kyrgyzstan and Tajikistan before recruiting South Asian nemeses India and Pakistan in 2017”

"The BRICS and the SCO share one important ideological quality: they are both focused on multipolarity, and their summits have even been held back to back with one another at times,"

So what is all this to say? The US financial system is breaking down. BRICs is rising. And most importantly, The CBDC agenda is being pushed by both the BRICs axis and the Western Axis.

We are not governed by serious people. I’m a pothead 24 year old (publishing this on my birthday), with no college degree, and somehow I just happened to see what was coming with BRICS ahead of the intelligence community and people who actually get paid to analyze? It isn’t that the blowback of US kicking Russia of SWIFT wasn’t entirely predictable - it was. That is how i predicted it. It is that our leaders, the politicians making decisions, and those that advise them, do not have the best interests of the American people at heart.

They are not going to fix our economic system in a way that is sustainable, or beneficial for future generations. While I have the utmost respect for people like Jeffrey Tucker, returning to hard money isn’t the only front that needs to be focused on. Returning to sovereign money is just as important, maybe even more so.

In Part 3 of my series from last year, I wrote about how Russia was transmutating sanctions as a way to artificially create demand to sell Gold to the Russian Bank by taking advantage of arbitrage created from sanctions - with the intention to later back the ruble by Gold Indeed

It isn’t just Russia, other BRICS+ central banks are busy accumulating gold reserves as well.

USfunds recently reported that “Central Banks Are Buying Gold At A Record Pace So Far In 2023”

The countries reporting purchases in the first 2 months were Singapore, Turkey, China, and Russia. It is worth noting that Turkey is a NATO wild card, like Hungary, that has been being threatened with sanctions by the US for not sanctioning Russia, and is drifting closer to the Russia/China axis as a result.

US Global Investors/ USfunds would write:

BRICS Countries Will Continue To Be Huge Buyers of Gold

If you look back at the list of net buyers, you’ll notice that three are members of the BRICS countries (Brazil, Russia, India, China and South Africa). I point this out because, as I’ve been sharing with you for a couple of weeks now, we may be seeing the emergence of a multipolar world, with a U.S.-centric world on one side and a China-centric world on the other. For the first time ever, BRICS countries’ share of the global economy has surpassed that of the G7 nations (Canada, France, Germany, Italy, Japan, the U.K. and U.S.), on a purchasing parity basis.

Gold plays an important role in this multi-polarization. The BRICS need the precious metal to support their currencies and shift away from the U.S. dollar, which has served as the global foreign reserve currency for about a century. More and more global trade is now being conducted in the Chinese yuan, and there are reports that the BRICS—which could eventually include other important emerging economies such as Saudi Arabia, Iran and more—are developing their own medium for payments.

If this is indeed the case, the implication is clear to me that investors should be increasing their exposure to gold and gold miners. Gold is a finite resource. It’s expensive and time-consuming to produce more of it. At the same time, BRICS countries will continue to be net buyers as they seek to diversify away from the dollar.

BRICS rising might represent a global drive to return to a form of hard money, in a BRICS commodity backed reserve currency, but it wont solve the problem of state controlled currencies, although I do believe that the reserve currency BRICs is working on will be backed by commodities, and could very well replace the dollar as the world reserve currency.

But even at that, it’s not like citizens of BRICs countries will be using the BRICS reserve currency, they’ll be using their domestic currency - in a fractional reserve system based off our own. China’s central bank has cut its reserve ratio 14 times since 2018, bringing it from 15% to where it is today, at 8%. China’s central bank governor said that reserve requirement ratio(RRR) cuts are “still an ‘effective’ way to support the economy and keep the liquidity at a reasonable level.”

It isn’t just the fractional reserve system that BRICs governments mirror, but they are just as on-board with the globalist agenda to control populations through CBDCs as the Western Axis is. Even more so as BRICS countries are the ones actually leading the way for, and piloting, CBDCs.

China, South Africa, India, Brazil, and even Russia, are all either piloting a CBDC, or have announced their intention to pilot one soon.

More and more people are waking up to the reality that is BRICS rising, and understand its predictable blowback as a result of US economic oppression and warfare, but not enough seem to understand that they are just the other side of the Globalist coin, designed to fill the savior role in opposition to the US boogeyman.

At the end of the day, we can’t just settle for hard money, if it isn’t sovereign money. If a state actor can freeze all your money because you said something they don’t like, it doesn’t really matter if it is backed by gold or not. Just my 2 sats.

Stay tuned to my Substack, I have a few articles I will be releasing over the next few weeks, in which I will cover topics ranging from “Brazil’s Jan 6th” and “Globalism Vs. Populism” to the developments of the BRICS axis and even a dive into the bigger picture of the sex trafficking problem that seems to pervade high society.