Russia Pegs Gold To Ruble, Rebounds to Pre-War Levels

Russia has just put the US in geopolitical check, looking to hybridize a new gold standard with the petrodollar — rather petroruble…

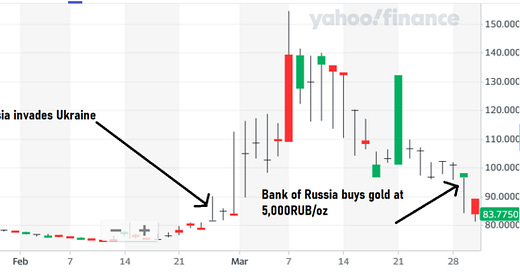

Russia has put the US in geopolitical check, looking to hybridize a new gold standard with the petrodollar — rather petroruble- dynamic. This week, Russia announced that it would buy gold at a fixed price of 5000 rubles per gram for 3 months in what is an attempt to create a new gold standard. In conjunction, Russia has begun demanding the countries seeking to purchase fossil fuels from Russia pay in either the Ruble or Gold, and is considering allowing bitcoin and alternative currencies to the dollar for “friendly” nations. Now that the ruble has completely recovered from its drastic collapse following sanctions, you have headlines like from today, “Ruble bounces back to pre-war levels. Putin’s plan is working for now”, which detailed some of the domestic policies Russia has implemented to help build support for the ruble.

What has Moscow done to boost the ruble?

-The central bank has more than doubled interest rates to 20%. That encourages Russian savers to keep their money in local currency.

-Exporters have been instructed to exchange 80% of their foreign currency earnings for rubles instead of sticking to US dollars or euros.

-Russian brokers are prohibited from selling securities owned by foreigners.

-Residents are not allowed to make bank transfers outside of Russia.

-Russia has threatened to demand payment for natural gas in rubles, not euros or dollars.

An article published through Seeking Alpha summarized “Russia’s 3-Step Program To Put The Ruble On A Gold Standard”:

Step 1: Offer a premium fixed price for gold to domestic Russian banks who can’t sell their gold internationally due to sanctions, encouraging domestic gold flows into Bank of Russia.

Step 2: Strengthen the Ruble internationally by insisting on energy payments in Rubles, turning fixed price into a premium internationally as well, encouraging international gold flows into Russia.

Step 3: Turn the Ruble into a credible gold substitute at a fixed rate.

The 5000RUB window closes June 30. Does Russia declare the Ruble convertible to gold after that? At what rate? Rather than speculate on the Ruble, just buy the gold.

Step 1: Accumulate Gold

Russia has been buying up Gold on the domestic market in advance of this announcement. The US went through the particular effort of sanctioning Russia specifically on foreign gold purchases alongside the general sanctions,. About three weeks ago, Russia’s central bank did temporarily halt its gold purchases due to a “surge in demand for gold as Russians rush to invest in bullion and coins to protect their savings” and to “leave the inventory for regular consumers.”

The central bank said in a statement attached to the policy announcement:

“Currently, households’ demand for buying physical gold in bars has increased, driven, in particular, by the abolition of value-added tax on these operations,” the central bank said in a statement on Monday.”

On March 9th, Putin had signed a law repealing the 20% value-added tax on metals purchases. This was meant to encourage precious metal purchases over foreign currencies as Russian citizens try to find safe havens in wake of the ruble is collapsing.

However, the period of the central bank’s abstinence from domestic Gold purchases has come to an end as of last week as the central bank has resumed gold purchases.

Step 2: Fix Price of Gold in Rubles, Encourage Foreign Gold Inflow

As stated, this week Russia announced that for a 3 month period they would establish the buying price of one gram of Gold to 5000 rubles($60)- effectively setting a floor(below the current world market price of ~$62.5 per gram).

The head of the Russian Parliament and Chairman of the Russian Duma Committee on Energy Pavel Zavalny, said last week that if countries seek to buy oil, gas, or other resources from Russia, “let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency.”

According to investing.com, Zavalny, representing Russia, has also been encouraging China to “de-dollarize” and switch to settlements in gold, rubles, or yuan.

By recently demanding “unfriendly” countries pay largely in either the Ruble or Gold, offering a 20% discount for their oil, they are creating an avenue for the inflow of gold reserves into the country. Additionally, the dynamic of sanctions on Russia’s gold coupled with their 5000 ruble-to-gram peg creates a perpetual arbitrage opportunity for the market that generates pressure to sell gold to the central bank. “AustroLib” writing for Seeking Alpha eloquently summarizes:

This is the price differential between Brent crude and Urals crude, in other words the difference between the price of oil outside Russia and oil inside Russia. True, the two grades of oil are not exactly the same, but the arbitrage has clearly exploded since the Ukraine invasion began. The extreme differential is obviously because of sanctions that cut off much of the Russian oil market to the rest of the world, and so whatever Russian oil can get through the firewall is offered at a major discount.

But the United States and its allies also are sanctioning Russian gold. And what does that do? It creates the same sort of price differential and arbitrage opportunity. Russian gold is much cheaper than non Russian gold now because Russian gold is cut off from the rest of the gold market and there’s risk of retaliation if you get caught buying it from Russia. The London Bullion Market Association has already banned Russian gold from its registries.

And so if you’re a Russian bank and you have some gold and you can’t sell it to someone out of the country except at a steep discount, and the Bank of Russia is offering to buy it from you at less of a discount, that’s still a premium for you, and the Bank of Russia splits the difference, increases its gold reserves, and in that way stabilizes the Ruble. Below is the Ruble/Dollar exchange rate since the beginning of the year.

This dynamic will generate consistent selling pressure of gold to Russia’s central bank due to the price differential of gold traders buying discounted Russian gold on the open market, and returning it to the central bank buying at a lower discount, to the profit of the arbitrage trader. The fixed rate for Russian Gold purchases these last 3 months is a test run of the 2nd part of that process. Being that the central bank has plenty of Ruble to spend, they will be accumulating gold, which they seek to tie the ruble to. Remember, this dynamic would not work if the US had not decided to try to isolate Russia economically by kicking them off Swift and imposing unilateral sanctions. The US is splintering the world economy by forcing an economic war, and Russia is taking advantage of that and seeking to topple the king.

One last excerpt from the piece reads:

“True, Russia eventually needs to “sell gold” at some point to get stuff it needs[peg a fixed rate for central bank sales of gold, versus a fixed purchase rate]. But Russia can do this without actually moving any of its gold. How so? It can simply declare the Ruble a hard gold substitute at a fixed exchange rate. In other words a gold standard. But before it does that, it first must make sure it has the required reserves if tested, which it’s now doing by splitting the arbitrage offered by Western powers that have sanctioned its gold and cut it off from global markets.

The Bank of Russia must also make sure its monetary policy is tight enough (now at 20% interest rates) to hold the line. Then it can insist on payment for Russian commodities in Rubles, now hard gold substitutes.

That’s the beauty of a money substitute, AKA a gold substitute in a gold standard system. The currency takes the place of gold, so you don’t have to physically move the stuff, which is a pain and expensive.

Western financial thought has this idea that if they cheapen Russian gold by sanctioning it, they’re hurting Russia by lessening the amount of stuff they could potentially buy with that gold. In fact, they’re actually helping Russia by encouraging gold inflows into the country and making it much cheaper for the Bank of Russia to amass much more gold to back the Ruble at a credible rate when the time comes.”

Step 3: Tie Ruble to Gold

According to Austrolib of Seeking Alpha, the next step is to “Strengthen the Ruble And Drain Gold From the West”. It is humorous to note that on March 4th, the following headline was published: “Ottawa sells off almost all its gold reserves, leaving just 77 ounces — or less”. But, as CBC noted in the article cited above:

“That doesn’t mean all governments are selling off their gold hoards, however. Countries such as Russia, India and China are currently bolstering their reserves. Central banks added 336 tonnes to their reserves in the second half of last year, a 25 percent increase from the previous year, the World Gold Council says.”

Precious metals expert Everett Millman was quoted by Kitco News saying that, “Russia’s intention would be for the value of the ruble to be linked directly to the value of gold. Setting a fixed price for rubles per gram of gold seems to be the intention. That’s pretty important when it comes to how Russia could seek funding and manage its central bank financing outside of the US dollar system.”

If Russia succeeds in creating a new Gold Standard, and simultaneously encourages the growth of oil purchases in the Ruble(even if the Yuan and native currencies emerge into acceptable currencies to trade oil in as well), this could be seen as a hybridization of the gold standard and petrodollar dynamic. This of course is in direct challenge to the US dollar as a reserve currency.

Zero Hedge reported in “How The West Was Lost: A Faltering World Reserve Currency”

Meanwhile, and despite the media’s attempt to paint Putin as Hitler 2.0, the Russian leader knows something the headlines are ignoring, namely: The world needs his oil.

Without Russian oil, the global energy and economic system implodes, because the system has too much debt to suddenly go it alone and/or fight back.

See how sovereign debt cripples options and changes the global stage? Meanwhile Russia, which doesn’t have the same debt to GDP chains around its ankle as the EU and US, can start demanding payment for its oil in RUB rather than USD.

As of this writing, Arab states are in private discussions with China, Russia and France to stop selling oil in USD. Such moves would weaken USD demand and strength, adding more inflationary fuel to a growing inflationary fire from Malibu to Manhattan.

I wonder if Biden, Harris or anyone in their circle of “experts” thought that part through?

Zerohedge would also summarize in agreeance with this article’s thesis:

The bottom line, however, is that the world is slowly moving away from a one-world-reserve-currency era to an increasingly multi-currency system.

Once the sanction and financial war genie is out of the bottle, it’s hard to put back. Trust in the West, and its USD-led currency system, is changing.

By taking the chest-puffing decision to freeze Russian FX reserves, sanction Russian IMF SDR’s and remove its access to SWIFT payments systems, the US garnered short-term headlines to appear “tough” but ushered a path toward longer term consequences which will make it (and its Dollar) weaker.

As multi-currency oil becomes the new setting, the inflationary winners will, again, be commodities, industrials and certain real estate plays.

Putin is predicting this as well, having recently broadcasted the message that, “Let me reiterate, the whole global economy and trade have suffered a major blow, as did the trust in the US dollar as the main reserve currency. The illegitimate freezing of some of the currency reserves of the Bank of Russia marks the end of the reliability of so-called first-class assets. In fact, the US and EU have defaulted on their [debt] obligations to Russia. Now everyone knows that financial reserves can simply be stolen, and many countries in the immediate future may begin — and I am sure this is what will happen- to convert their paper and digital assets into real reserves of raw materials: land, food, gold and other real assets.”

These Chess Moves Could Be What Topples the Dollar and Initiates a Multi-Polar World Order Composed of Regional Blocs

This month I wrote 2 pieces, “Ukraine Crisis Triggered a Massive Shift in Fundamentals for Bitcoin” on March 8th, and “US Hegemony Threatened As Saudis, UAE, India Ignore Threats of Sanctions, Turn to Russia and China” on the 19th. This is Part 3, as the predictions of the first two are being validated by recent developments, and the concepts introduced in those synthesize to support the foundation of this one.

To recap for the sake of readers who did not read the first two, the thesis points of the “Ukraine Crisis Triggered a Massive Shift in Fundamentals for Bitcoin” essentially said rising energy prices would reduce selling pressure of bitcoin, and sanctions would increase demand(for it as well as other commodities) as Russia and its trade partners seek to avoid them with its conclusion including:

The Ukraine/Russia conflict has shifted the short and mid-term fundamentals of bitcoin in that the Federal Reserve will likely be less aggressive in contractionary policy now and possibly even hold off on it all together depending on how things play out.

B. Sanctions and Swift System dissolution highly incentivize bitcoin and crypto usage by central banks and international traders/importers/exporters as a reserve currency, for the short to long term.

C. The American Empire is likely in its death throes, as it desperately seeks to retain dominance. Maybe its time to hedge against US hegemony.

In the conclusion, I largely analyzed the current state of the world through the lens of Ray Dalio’s “big cycle” of the rise and fall of empires, and how “empires nearly always end with debt crises, debasement/devaluation of an empires currency, and the diminishing role of its currency as a reserve currency”. Just as the ends of empires are marked by the decline of their reserve currency status, so too is their rise to power marked by the rise of their currency as a reserve currency. The conclusion postulated a fork in the road for humanity, we could either repeat the cycle, or start to decentralize power.

Since my article’s publication(featured on Bitboycrypto.com and CoinMonks), We’ve seen headlines such as “Goldman Admits Saudi-China Oil-Trade Signals ‘Erosion’ Of Dollar Reserve Status” and “The U.S. must bust up the new China-Russia-Saudi Axis of Oil”

Just Yesterday, Russia’s foreign minister announced that Russia was aiming to build a new “democratic world order” with China. Capitalizing off the desire for sovereignty among the world’s countries and populations that find themselves pressured(or rather coerced due to both implied and explicit threats)to act as a US vassal state, Sergey Lavrov said:

“We, together with you, and with our sympathizers will move towards a multipolar, just, democratic world order.”

Days before the Ukraine war, as CBS reported, in a joint statement between Russia and China to the world during the opening ceremony of the Beijing Olympics, they released a statement that “sought to portray Russia and China not as challengers of democracy and freedom on the world stage, but as purveyors of it.

Part of the joint statement read as follows:

“Some forces representing a minority on the world stage continue to advocate unilateral approaches to solving international problems and resort to power politics, practice interference in the internal affairs of other states, damaging their legitimate rights and interests, provoking contradictions, disagreements and confrontation.”

That is the message they have continued promoting, while the US promotes it as battle between democracy and autocracy.

US Bully Archeotype Will Be Its Downfall, World Has Had Enough

Many of the tactics of these so called “power politics” involve economic warfare such as sanctions, which also involve threat and the threat of violence for those that do not comply. It is what many have been saying for years, such as Tulsi Gabbard and Ron Paul. It is obvious to all who have a basic understanding of what unilateral sanctions on a country’s economy actually means, and ramifications of the ease at which the US threatens countries with this. Who wants to be ruled by a trigger happy madman ready to mass-murder your civilians if you don't comply to their demands? That's, as they say, bad for business.

Of course, besides economic warfare as a means of control, you have the more overt forms such as military action or coups. But ultimately, these forms of imperialism and disregard for sovereignty, are not sustainable as it does not build healthy relationships between countries. The vassal states often come to feel exploited, like a host of a parasite, versus a mutually beneficial relationship. Russia and China are taking this feeling and presenting themselves as a solution, broadcasting the message that they will respect the sovereignty of other countries. Ultimately, I don’t think that is their true intention, especially China, but that is not the point of this article. The point is -just like US elections- the world often finds itself choosing between the lesser of 2 evils — and the assurances from the China/Russia bloc are more appealing to many than the other option of allowing the US to continue dominating on top. The fact is, the US doesn’t respect the sovereignty of other nations, and the China/Russia axis is giving assurances that they will.

In “US Hegemony Threatened As Saudis, UAE, India Ignore Threats of Sanctions, Turn to Russia and China”, I broke down the causes of, and pointed to, the effect of the US pushing neutral countries into the arms of Russia and China. Namely Saudi Arabia, India, South Africa. Although that's becoming ever more apparent by the week as NATO continues attempting to force sides, with, for example, a recent headline reading, “Hungary’s Orban criticized for ‘neutrality’ in Ukraine war”

While his approach has gained traction among many of his supporters, Orban’s reluctance to act unambiguously in support of Ukraine and his insistence on maintaining his Russian economic interests has led to frustration and outrage among other European leaders — not least the Ukrainian president himself…

“I want to stop here and be honest, once and for all. You have to decide for yourself who you are with,” Zelenskyy said.

In my first article, I concluded the following:

“As Saudi Arabia is seeking to abandon the Petrodollar, India is seeking to phase out the dollar as a reserve currency in trade with Russia (and likely its trade partners such as China in the future), the dollar’s reserve currency status faces a great threat. Saudi Arabia’s departure from the standard it was instrumental in creating could embolden other countries to follow suit. Likewise, as multiple countries bolster relations with Russia and China(Or allies of theirs, such as the UAE meeting with Syrian president Assad), and defy the US’s wishes and implicit or direct threats, this could embolden others to do the same in the future-dismantling US hegemony.”

The concluding paragraph read:

“We could be witnessing the fall of the US empire, and its reserve currency, coincided by the rise of an emerging power structure and world economic system in which BRICS nations rise as the new dominant power of the globe.”

Since then, an increasing proportion of the media, world governmental bodies, and political commentators are increasingly acknowledging the observable reality of the situation. Yesterday, the deputy foreign minister of Russia said BRICS countries (Brazil, Russia, India, China, and South Africa) will be at the heart of a “new world order”.

“In all respects … these countries will become the basis of a new world order,” the deputy foreign minister said, going on to tell RT that Russia is working to establish contacts with any country that is interested in cooperation

Russian diplomat, Ryabkov, told RT regarding the decision to demand ruble payments for gas contracts with ‘unfriendly’[nato-allied] countries:

“We are not modifying [the terms of] contracts, we are protecting our interests from a tsunami, a wave of totally irresponsible sanctions that just hit the foundations of international trade and the international system,” Ryabkov told RT.

As previously mentioned, its not just rubles they are willing to accept for gas(or other exports), but gold. Likewise, they have been openly considering accepting bitcoin as payment to avoid sanctions for the past week — causing it the digital currency to soar. Likewise, they are willing to accept native currencies of friendly currencies which doesn’t force them to trade their native currency for another on the open market, devaluing the currency they sale and putting buying pressure on the currency they convert to.

“The dollar ceases to be a means of payment for us, it has lost all interest for us,” Zavalny added, calling the greenback no better than “candy wrappers.”

“We have been proposing to China for a long time to switch to settlements in national currencies for rubles and yuan. With Turkey, it will be lira and rubles.

You can also trade Bitcoins.”

With the mention of Lira, it is worth noting that Turkey’s Erdogan already told Putin in early March that Turkey is willing to trade in the Yuan, Ruble, or Gold. Another country we are pushing into the Russia/China block’s arms. Russia and India have made further strides in trading in the Ruble and Rupee. The recent round of India-China peace talks were said. to be “positive and constructive” by China. Meanwhile, as Antiwar.com reported on March 31st in an article titled, “US Warns India Against Significant Increase in Russian Oil Imports”, the US is continuing to threaten India for conducting trade in India’s own interest:

“A Biden administration official told Reuters that a significant rise in Russian oil imports by India could expose New Delhi to “great risks” as Washington is stepping up its threats against India for its cooperation with Moscow

A Biden administration official told Reuters that a significant rise in Russian oil imports by India could expose New Delhi to “great risks” as Washington is stepping up its threats against India for its cooperation with Moscow

I covered the previous threats of sanctions in “US Hegemony Threatened As Saudis, UAE, India Ignore Threats of Sanctions, Turn to Russia and China”, explaining how this strategy is counterproductive- the implication of my first two articles in totality being even that the fact that this strategy is our immediate go-to reaction is perhaps the fundamental root reason why countries want to distance themselves in the first place:

The US went as far as to threaten sanctions on India, if they did not sanction Russia. What was the outcome of such attempted coercion? Blowback that negatively impacted the financial security of the US, and the strength of the dollar. India just bought 3 million barrels of oil from Russia . They are even considering abandoning the dollar for trade with Russia, which thus far has been the standard.

…Keep in mind, India imports 85% of its oil, and the country’s overall demand is expected to jump over 8% this year. Economically, buying discounted oil from Russia is undisputedly in India’s best interest.

While we are on the topic of the US pushing away countries into the arms of Russia and China through its aggression and coercion, the thesis of my last article, it is worth pointing out the recent news, “Cambodia Signs Military Deal With China After US Pressure”.

The militaries of Cambodia and China have signed a memorandum of understanding to boost cooperation. The deal comes after the Biden administration hit Cambodia with sanctions and an arms embargo over its relationship with China.

Meanwhile Putin is demanding rubles from “unfriendly “ nations — which G7 recently rejected, but others seem to be weighing options. Greece held an “emergency meeting” on the 31st at the time of writing regarding Putin’s demand for rubles.

Germany, a major member of G7, is on edge having to ration(as is many European countries like Austria). While they rejected the Ruble demand, they have yet to be cut off as trade continues, as recently, “the Russian leader said money would be paid into Gazprom Bank, which is not a subject of sanctions, and then transferred in rubles to Russia”[which still creates buying pressure on the ruble but Russia takes slight liquidity loss in payments due to conversion]. Russia is testing the waters and seeking to push back against the US sanctions and come out stronger on the other side. So far, the Ruble has done so. Time will tell how the future proceeds. It is worth noting that while Russia is taking advantage of the sanctions and attempting to transmutate them, like a martial arts fighter redirecting the force of an opponent to its advantage, these sanctions hurt the rest of the world. Antiwar.com noted in “Lavrov Says the West Has Launched a ‘Total, Hybrid War’ Against Russia”

“The sanctions have done nothing to stop the fighting in Ukraine and are having an impact on the entire world, as President Biden warned on Thursday. ‘The price of these sanctions is not just imposed upon Russia, it’s imposed upon an awful lot of countries as well, including European countries and our country as well.’ ”

What This All Means

In Brett Arend of MarketWatch’s coverage of the recent move by Russia to peg Gold purchases to the ruble, the following was concluded:

What will this mean? Maybe nothing. Or maybe a lot. Especially if Russia’s lead is followed by countries such as China, India and others — countries that may not welcome Washington’s ability to control the global financial system through its monopoly power over the global reserve currency.

And this adds to the argument for having at least some gold in a long-term investment portfolio. No, not because it is guaranteed to rise, or maybe even likely to. But because it might — and might do so while everything else went nowhere, or went down[a hedge]. Like in a geopolitical or financial crisis where the non-western bloc decides to challenge America’s financial hegemony and ”king dollar.”

Investing.com published an article titled “Currency Wars Center On Russia’s Gold” that nicely summed up:

Global confidence in the Federal Reserve Note US dollar as world reserve currency is rapidly eroding.

If the U.S. can suddenly declare that it is freezing the dollar assets of a major foreign central bank and banning their gold from circulation, a lot of other countries will be worried they might be next to get blacklisted. They will naturally want to have a Plan B in place. …

Ever since the U.S. rescinded gold convertibility in 1971, the fiat “dollar standard” has been in force — backed implicitly by oil and the promise of Saudi Arabia and other OPEC producers to [exclusively]accept dollars as payment[creating consistnt buying pressure of USD on markets upholding value and cushioning inflation and essentially backing the dollar by global oil demand].

The petro-dollar is now at risk of losing its hegemony. While the U.S. has historically been able to use its financial and military might to keep Middle Eastern countries in line, it may be overplaying its hand in trying to force the entire world to shun Russia.

As with waging any war, however justified it may be, there will be blowback. The overt weaponization of the financial system against Russia will result in counterattacks directed at the Federal Reserve Note.

A currency’s value cannot be maintained through force alone. Plenty of dictatorships throughout history have gone down the economically ruinous path of hyperinflation.

Is Russia even winning the geopolitical war, or are we shooting ourselves in the foot? Either way, the path ahead is bleak in terms of economic stability. Just after my last article publication, Biden himself had said, “We are at an inflection point, I believe, in the world economy — not just the world economy, in the world. … And now is a time when things are shifting. We’re going to — there’s going to be a new world order out there, and we’ve got to lead it.”

Tulsi Gabbard would comment on it in an interview, reminding Biden “you are not God”, going on to say that “if you try to pretend that you are, what will result — even with good intentions — what will result, unfortunately, is more suffering, more hardship for the people in the world [whom] supposedly he’s trying to save, but also for the American people.”

“Because Joe Biden’s already told us, ‘Hey, freedom is not free. You, the American people are going to pay the price.’ And … that is exactly what we will see play out if he continues to think that he is and can be somehow the controller of all people and all things in this world.”

Yesterday, the Daily Mail published the headline, “President of BlackRock investment firm warns an ‘entitled generation’ needs to brace for shock of shortages and higher inflation: Experts warn Americans will pay an EXTRA $433 a month for basic goods this year”

Essentially Blackrock is saying “Brace yourself peasants, the lordship’s siege warfare is backfiring and ye(et) serfs shall pay the cost.” France is mulling expanding food stamps. Biden said 3 days ago, and I quote, “Shortages are gonna be real”. At least he is keeping it G — although some such as CSPAN formalized his quote and eliminated the contraction in their quotations if that’s even worth mentioning(in truth, I just find it humorous).

I digress, Russia seems to be outplaying the US in geopolitical chess. This is reflected by the Ruble’s recent rebound to post-war levels and the continued deterioration of US-foreign relations. The US dollar is likely to continue to fall under increased criticism as a reserve currency, the impact of the economic war the US has initiated will grow, and hedging one’s money against US hegemony, whether that’s increasing exposure to commodities, crypto, or just buying fertilizer and bullets, is likely a good idea. If Western Leadership doesn’t check itself, it is looking like Russia will checkmate it.

4/01 Update: Putin Sets Deadline For Ruble Gas Payments [April 1st]

“Russian President Vladimir Putin has signed a decree, on Thursday, demanding ruble gas payments for buyers from so-called “unfriendly” countries. These are states which have placed sanctions on Moscow in connection with the ongoing conflict in Ukraine.

The measure takes effect on Friday and requires that buyers open accounts in Russian banks to facilitate the payments. …

“If unfriendly countries do not pay in rubles starting from April 1, we will consider this a default on gas contracts, in which case the existing contracts will be scrapped,” the president said.”

Join Coinmonks Telegram Channel and Youtube Channel learn about crypto trading and investing